PREIT Reports Second Quarter 2021 Results

Year-to-Date Leasing Pipeline Exceeds That of Past Five Years

Liquidity Profile Continues to Improve; Total Liquidity of $104.9 Million at End of Second Quarter

June Sales for Comparable Tenants Increase 16% over June 2019

Total Core Mall Leased Space Improved to 92.6%

PREIT (NYSE: PEI) today reported results for the three and six months ended June 30, 2021. A description of each non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is provided in the tables accompanying this release.

“We believe this quarter marks the inflection point in the turnaround of our business and the evolution of PREIT. It is now clear that the work we have done in creating a stronger portfolio by selling off 19 lower-productivity properties, repositioning 19 anchor boxes with over 3 dozen new tenants and securing a differentiated tenant base is driving results. Our portfolio is generating tremendous momentum with strong same store NOI growth, that is expected to continue through the balance of the year, tenant sales ahead of pre-pandemic levels and a leasing pipeline that exceeds any of the past five years’ activity,” said Joseph F. Coradino, Chairman and CEO of PREIT. “Consumers are demonstrating their desire to return to in-person shopping and are attracted to the mix of tenants at our properties that meet the changing needs of today’s consumer.”

- Same Store NOI, excluding lease termination revenue, increased 53.9% for the three months ended June 30, 2021 compared to the three months ended June 30, 2020.

- For the quarter, results were driven by an increase in real estate revenue of $17.7 million primarily due to prior year pandemic-related store closings and rent abatements and the increase in credit losses for challenged tenants for the three months ended June 30, 2020, partially offset by reduced expense recoveries resulting from temporary rent restructuring.

- Second quarter 2020 Same Store NOI would have been $43.4 million when adjusted for the $10.5 million in rental abatements granted. Quarterly Same Store NOI grew by 16.6% over this adjusted amount.

- For the fourth straight quarter, collections improved with cash collections increasing to 127% of billings for the second quarter of 2021. We collected 88% of billed second quarter 2021 rents, an increase from receipts of 81%, 73% and 61% of billed rents as of the end of each of the past three quarters, respectively. Momentum continued in July with 91.4% of billed rents collected, or 126% on a cash collections basis.

- The Company’s accounts receivable balance decreased again in the second quarter of 2021, down to $37.8 million as of June 30, 2021 from $54.5 million as of December 31, 2020.

- As a result of strong collections, net cash generated from operating activities totaled $34.7 million for the six months ended June 30, 2021 compared to $3.7 million used in the six months ended June 30, 2020.

- Robust leasing activity is driving increased occupancy with Core Mall total occupancy increasing 100 basis points, sequentially, to 90.2%. Core Mall non-anchor occupancy increased 80 basis points, sequentially, to 87.8%.

- Total Core Mall leased space, at 92.6%, exceeds occupied space by 240 basis points, and total non-anchor leased space, at 90.4%, exceeds occupied space by 260 basis points when factoring in executed new leases slated for future occupancy, demonstrating the rapid pace of leasing activity.

- Sales grew at over 80% of properties, with comparable tenants, meaning that reported sales in both periods, reporting sales growth of 16% over in June 2021 when compared to June of 2019.

- Average renewal spreads for the six months ended June 30, 2021 declined by 1.0%. COVID-related rent concessions impacted quarterly renewal spread results for tenants under 10K square feet by 370 basis points.

Leasing and Redevelopment

- 500,000 square feet of leases are signed for future openings, which is expected to contribute annual gross rent of $10.8 million.

- Leasing momentum continues to build with transactions executed or in the process of being negotiated for 1.2 million square feet of occupancy thus far in 2021.

- Construction is underway for Aldi to open its first store in the portfolio at Dartmouth Mall in Dartmouth, MA in Q3 2021.

- A lease has been executed for a new self-storage facility in previously unused below grade space at Mall at Prince George’s in Hyattsville, MD with an anticipated opening in Q1 2022.

- Tilt Studios is under construction to replace JCPenney at Magnolia Mall in Florence, SC. The family-focused destination is expected to open in Q3 2021.

- A transaction has been executed with Cooper University Health Care for an outpatient location in the former Sears space at Moorestown Mall in Moorestown, NJ.

- The Company executed a rezoning agreement to allow for the addition of up to 1,065 multifamily units and a hotel at Moorestown Mall.

- A lease has been executed with Turn 7 to occupy the former Lord & Taylor space at Moorestown Mall. Turn 7 will open this fall selling ever-changing overstocked merchandise from online channels at a discount, in a fast-paced, fun atmosphere.

- A lease is nearly finalized with an entertainment destination to replace the former JCPenney at Willow Grove Park, adding family entertainment to this locally-loved destination shopping experience.

Primary Factors Affecting Financial Results for the Three Months Ended June 30, 2021 and 2020

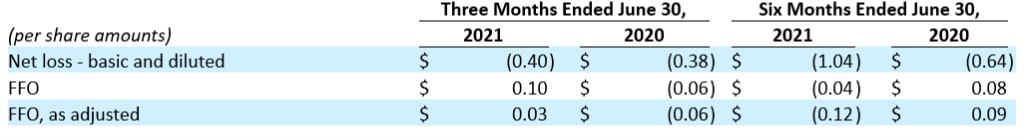

- Net loss attributable to PREIT common shareholders was $31.4 million (which takes into consideration the accrual of preferred dividends that accumulated during the quarter but have not been paid), or $0.40 per basic and diluted share for the three months ended June 30, 2021, compared to net loss attributable to PREIT common shareholders of $29.2 million, or $0.38 per basic and diluted share for the three months ended June 30, 2020.

- Same Store NOI, including lease terminations, increased by $20.7 million, or 62.3%. The increase is primarily due to tenant store closings and rent abatements and increased credit losses that occurred in the prior year, partially offset by a reduction in expense recoveries resulting from tenant restructuring transactions.

- Non-Same Store NOI increased by $0.5 million, primarily due to high credit losses in the prior year, partially offset by the transfer of property at Valley View Mall during the third quarter of 2020.

- FFO for the three months ended June 30, 2021 was $0.10 per diluted share and OP Unit compared to $(0.06) per diluted share and OP Unit for the three months ended June 30, 2020. Adjustments to FFO in the second quarter of 2021 were primarily related to $(0.06) per share from gain on debt extinguishment and $(0.01) per share from gain on hedge ineffectiveness.

All NOI and FFO amounts referenced as primary factors affecting financial results above include our share of unconsolidated properties’ revenues and expenses. Additional information regarding changes in operating results for the three and six months ended June 30, 2021 and 2020 is included on page 15.

Liquidity and Financing Activities

As of June 30, 2021, the Company had $75.2 million available under its First Lien Revolving Credit Facility. The Company’s corporate cash balances, when combined with available credit, provides total liquidity of $104.9 million.

During the quarter, the Company entered into over $175 million of mortgage loans, in the aggregate and reflecting the Company’s share. The mortgages are secured by Viewmont Mall, Francis Scott Key Mall, two of the Company’s joint venture open-air assets, Court at Oxford Valley and Red Rose Commons and a developable land parcel. These refinancing transactions extended the Company’s nearest-term maturities.

Asset Dispositions

Multifamily Land Parcels: The Company has executed agreements of sale for land parcels for anticipated multifamily development in the amount of $87.2 million. The agreements are with multiple buyers across five properties for approximately 2,200 units as part of Phase I of the Company’s previously announced multifamily land sale plan. Closing on the transactions is subject to customary due diligence provisions and securing entitlements.

Hotel Parcels: The Company has an executed agreement of sale to convey a land parcel for anticipated hotel development in the amount of $2.5 million for approximately 125 rooms. Closing on the transaction is subject to customary due diligence provisions and securing entitlements.

–

2021 Outlook

The Company is not issuing detailed guidance at this time.

Conference Call Information

Management has scheduled a conference call for 11:00 a.m. Eastern Time on Thursday

August 5, 2021, to review the Company’s results and future outlook. To listen to the call, please dial 1-844-885-9139 (domestic toll free), or 1-647-689-4441 (international), and request to join the PREIT call, Conference ID 4436069, at least fifteen minutes before the scheduled start time as callers could experience delays. Investors can also access the call in a “listen only” mode via the internet at the Company’s website, preit.com. Please allow extra time prior to the call to visit the site and download the necessary software to listen to the Internet broadcast. Financial and statistical information expected to be discussed on the call will also be available on the Company’s website.

For interested individuals unable to join the conference call, the online archive of the webcast will also be available for one year following the call.