PREIT Reports Fourth Quarter and Full Year 2019 Results and Provides Balance Sheet Strategy Update

Executed Agreements of Sale for $313 Million in Gross Proceeds Core Mall NOI-Weighted Sales per square foot Reached $547 Core Mall Leased Space Increased to 96.6%

PREIT (NYSE: PEI) today reported results for the three months and the year ended December 31, 2019. A description of each non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is located in the tables accompanying this release.

Joseph F. Coradino, Chairman and Chief Executive Officer of PREIT, said, “As we look into 2020, we are beginning to believe that industry headwinds are moderating and the strategic initiatives underway at PREIT will drive growth and value creation. We have taken proactive steps to manage industry-wide disruption, such that today 47% of our non-anchor space is leased to non-mall retail tenants. We have achieved strong momentum in the first five months of operation at Fashion District Philadelphia, and look forward to the continued success of that project.”

Joseph F. Coradino, Chairman and Chief Executive Officer of PREIT, said, “As we look into 2020, we are beginning to believe that industry headwinds are moderating and the strategic initiatives underway at PREIT will drive growth and value creation. We have taken proactive steps to manage industry-wide disruption, such that today 47% of our non-anchor space is leased to non-mall retail tenants. We have achieved strong momentum in the first five months of operation at Fashion District Philadelphia, and look forward to the continued success of that project.”

Coradino added, “Our growing sales and traffic, along with modest same store NOI growth projected amid continued retail market uncertainty, demonstrate that our strategy is working. Further, we believe the capital transactions we are embarking upon demonstrate that the quality of our portfolio provides us with opportunities to efficiently access the capital markets.”

- Same Store NOI, excluding lease termination revenue, decreased 3.0% for the three months ended December 31, 2019 compared to December 31, 2018.

- The quarter was impacted by an incremental decrease in revenue of $2.3 million as a result of bankruptcies, related store closings and associated write-offs. This was partially offset by incremental revenues from anchor replacements and other leasing activity of $1.1 million in the quarter.

- Same Store NOI, excluding lease termination revenue, decreased 2.5% for the year ended December 31, 2019 compared to December 31, 2018. Excluding the impact of revenue lost from bankruptcy-related store closings, Same Store NOI, excluding lease termination was positive.

- For the full year ended December 31, 2019, the Company was impacted by $6.9 million of lower revenue compared to the prior year as a result of bankruptcies, related store closings and associated write-offs, which was partially offset by $3.5 million in incremental rent from anchor replacements and other leasing activity.

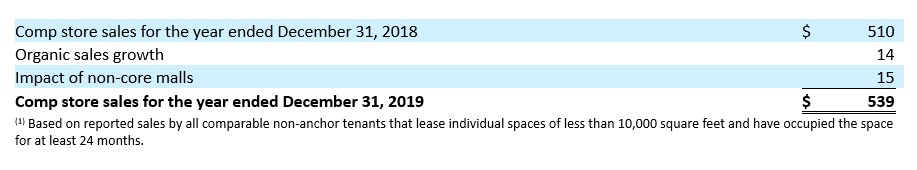

- NOI-weighted sales at our Core Malls increased to $547 per square foot. Core Mall sales per square foot reached $539, a 5.7% increase over the prior year. Average comparable sales per square foot at our top 6 properties rose 5.0% over the prior year to $646 with two properties generating sales over $700 per square foot.

- Core Mall total occupancy was 95.5%, an increase of 110 basis points compared to September 30, 2019. Core Mall non-anchor occupancy declined by only 70 basis points from last year despite the impact from bankruptcies and chain liquidations that resulted in 71 store closures in 274,000 square feet during the year ended December 31, 2019.

- Non-anchor Leased space exceeds occupied space by 170 basis points when factoring in executed new leases slated for future occupancy, excluding Fashion District Philadelphia.

- Average renewal spreads for the full year were strong in our wholly-owned portfolio at 6.7% for spaces less than 10,000 square feet and 5.5% for large format spaces. Average renewal spreads for the entire portfolio were 2.5% for the year.

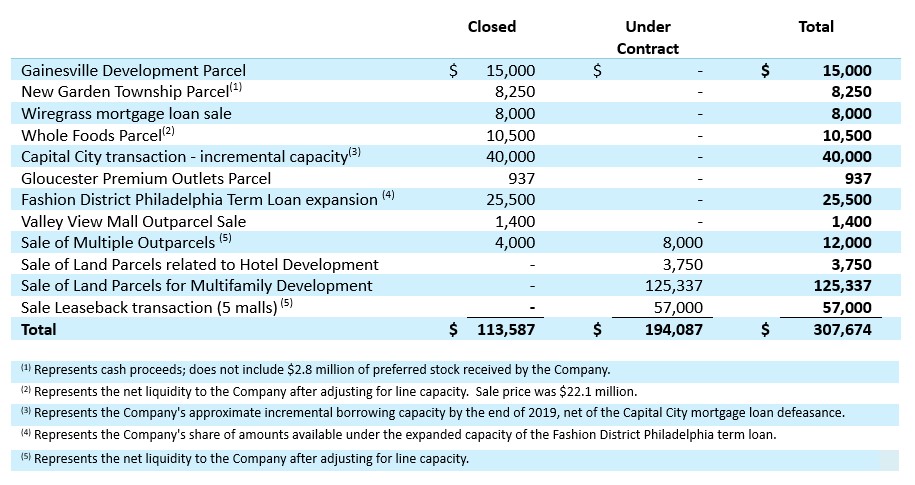

- As part of the Company’s plan to improve our balance sheet, since last quarter, the Company has executed agreements of sale for expected gross proceeds of $312.6 million. These include an agreement for the sale – leaseback of five properties for $153.6 million, the sale of land parcels for multifamily development in the amount of $125.3 million, $29.9 million related to operating outparcel sales, and $3.75 million related to the sale of land for hotel development. Upon closing of these transactions, the Company expects to net nearly $200 million in additional liquidity. These transactions, together with potential modifications to our credit facility covenants, create the runway needed in order to complete execution of our business plan.

- The Company anticipates not meeting certain financial covenants during 2020. The Company is in active discussions with its lenders to modify the terms of its debt covenants to ensure compliance through September 30, 2020 and anticipates further discussions with lenders to modify the terms of the debt agreements on a long term basis.

Leasing and Redevelopment

- Excluding Fashion District Philadelphia, 425,000 square feet of leases are signed for 2020 openings, which is expected to contribute annual gross rent of $13.1 million.

- On September 19, 2019, the Company’s 50/50 joint venture with Macerich opened Fashion District Philadelphia, a four-level retail hub in Center City spanning nearly 900,000 square feet across three city blocks in the heart of downtown Philadelphia. The project, which represents an impressive collection of retail, entertainment and co-working uses, is 87% committed. Noteworthy post-opening additions include: AMC Theaters, Round One, Wonderspaces, Armani Exchange Outlet and Sephora. Upcoming additions include: Primark, Industrious, Kate Spade, DSW Shoes and more.

- At Plymouth Meeting Mall, Michael’s will join recently opened Burlington, DICK’s Sporting Goods, Miller’s Ale House and Edge Fitness in the location of the former Macy’s at the end of February 2020.

- On October 12, 2019, the expansion wing at Woodland Mall opened anchored by a brand new, top-quality Von Maur Department Store. New tenants in the wing include: Urban Outfitters, Tricho Salon & Spa, Williams-Sonoma, Black Rock Bar & Grill, Paddle North and The Cheesecake Factory. In Spring 2020, the expansion area will welcome White House | Black Market and Sephora.

- At Willow Grove Park, Yard House opened in December 2019 and construction continues on the 51,000 square foot Studio Movie Grill, which is projected to open in the first half of 2020.

- At Valley Mall, DICK’s Sporting Goods is underway with fixturing and stocking with an anticipated opening in March 2020.

- At Dartmouth Mall, the 43,000 square foot Burlington is expected to open in March 2020. The redevelopment plan also includes approximately 35,000 square feet of new outparcels to capitalize on the property’s location.

Primary Factors Affecting Financial Results for the Three Months Ended December 31, 2019 and December 31, 2018:

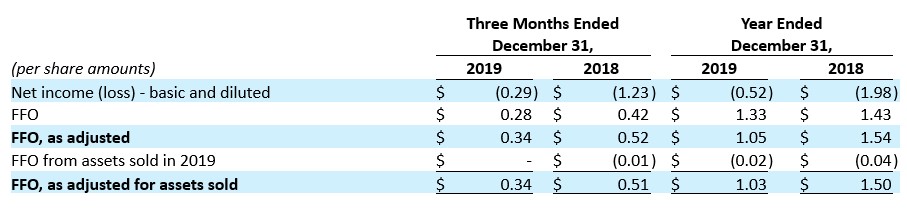

- Net loss attributable to PREIT common shareholders was $21.7 million, or $0.29 per basic and diluted share for the three months ended December 31, 2019, compared to net loss attributable to PREIT common shareholders of $85.6 million, or $1.23 per basic and diluted share for the three months ended December 31, 2018.

- Same Store NOI decreased by $2.4 million, or 3.8%. Revenue from new store openings, including contributions from replacement anchors, mitigated the impact of revenue lost to bankruptcies and associated store closings. Lease termination revenue was $0.6 million less than the prior year’s quarter.

- Non Same Store NOI decreased by $2.0 million, primarily driven by the disposition of Wyoming Valley Mall, anchor closings and associated co-tenancy rents at Valley View Mall and the sale of the Whole Foods parcel at Exton Square, slightly offset by contribution from Fashion District Philadelphia.

- FFO for the three months ended December 31, 2019 was $0.28 per share and OP Unit compared to $0.42 per share and OP Unit for the three months ended December 31, 2018. Adjustments to FFO in the 2019 quarter included $0.04 per share of provision for employee separation expenses and $0.03 of impairment of development land parcels. Adjustments to FFO in the fourth quarter of 2018 included a loss on mortgage note impairment, provision for employee separation expenses, and net insurance recoveries that totaled $0.10 per share.

- General and administrative expenses were impacted by the new lease accounting standard that now limits the capitalization of certain leasing costs. We expensed $1.1 million ($0.01 per share) of costs in the three months ended December 31, 2019 that would have been capitalized under the prior standard.

All NOI and FFO amounts referenced as primary factors affecting financial results above include our share of unconsolidated properties’ revenues and expenses. Additional information regarding changes in operating results for the three months and year ended December 31, 2019 and 2018 is included on page 18.

Asset Dispositions

During the fourth quarter of 2019 and in early 2020, the Company has executed agreements of sale for expected gross proceeds of $312.6 million.

Sale/Leaseback: In February 2020, The Company entered into an agreement of sale for the sale and leaseback of five properties for $153.6 million. Structured as a 99-year lease with an option to repurchase, the agreement provides for release of parcels related to multifamily development and is subject to ongoing lease payments at 7% ($10.75 million) with annual 1.25% escalations. Closing on the transaction is subject to customary closing conditions, including due diligence provisions.

Multifamily Land Parcels: In 2020, the Company executed seven agreements of sale for land parcels for anticipated multifamily development in the amount of $125.3 million. The agreements are with four different buyers across seven properties for 3,450 units as part of Phase I of the Company’s previously announced multifamily land sale plan. Closing on the transactions is subject to customary due diligence provisions and securing entitlements.

Outparcels: The Company has executed an agreement of sale with Four Corners Property Trust (“FCPT”) for 14 outparcels, generating $29.9 million in total proceeds. We have closed on the sale of four of the parcels, totaling $10.5 million. The remaining 10 are expected to close in 2020 and are subject to customary due diligence provisions.

Hotel Parcels: The Company has executed two agreements of sale conveying land parcels for anticipated hotel development in the amount of $3.8 million. The agreements are with two separate buyers for approximately 250 rooms. Closing on the transactions is subject to customary due diligence provisions and securing entitlements.

2019 and Year-to-Date 2020 Capital Transaction Summary

The table below summarizes 2019 and 2020 capital activity that is expected to impact the Company’s liquidity position:

Retail Operations

The following table sets forth information regarding sales per square foot in the Company’s mall portfolio, including unconsolidated properties:

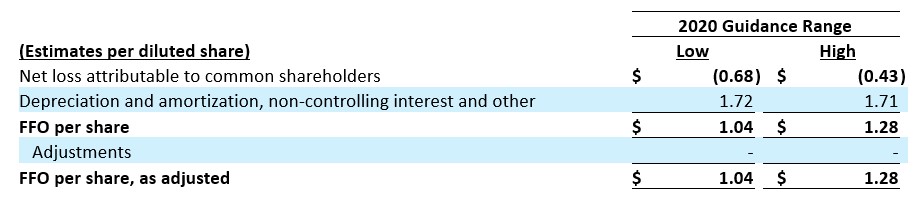

2020 Outlook

The Company is introducing its earnings guidance for the year ending December 31, 2020 of GAAP Net loss between ($0.68) and ($0.43) per diluted share and estimates FFO for the year will be between $1.04 and $1.28 per diluted share. FFO, as adjusted per share is expected to be between $1.04 and $1.28.

A reconciliation between GAAP net loss and FFO is as follows:

Guidance Assumptions:

Our guidance incorporates the following assumptions, among others:

- Same Store NOI, excluding termination revenue is expected to grow between 0.5% and 1.5% with wholly-owned properties in the range of (0.2%) to 0.8% and joint venture properties increasing between 4.7% and 6.0%;

- Lease termination revenues of $1.0 to $2.0 million;

- Share of NOI from Fashion District included in Same Store NOI in Q4 2020;

- Bankruptcy and store closings reserve of between $2.0 at the midpoint to $3.0 million at the low end of Same Store NOI guidance;

- Land Sale Gains are expected to be between $14.4 and $28.8 million inclusive of the assumption that we close the hotel land sales and between two and four of the multifamily land sales in 2020;

- Weighted average shares and OP units of 81.0 million for FFO and 77.0 million for Net (loss) income;

- Capital expenditures in the range of $125 to $150 million, including redevelopment expenditures, recurring capital expenditures and tenant allowances; and

- Our guidance does not incorporate the effects of the recently executed sale leaseback transaction, which are estimated to be approximately $0.06 dilutive to FFO per share on an annual basis.

- Our guidance does not assume any other capital market transactions.

Our 2020 guidance is based on our current assumptions and expectations about market conditions, our projections regarding occupancy, retail sales and rental rates, and planned capital spending. Our guidance is forward-looking, and is subject to risks, uncertainties and changes in circumstances that might cause future events, achievements or results to differ materially from those expressed or implied by the forward-looking statements.

Conference Call Information

Management has scheduled a conference call for 11:00 a.m. Eastern Time on Wednesday,

February 26, 2020, to review the Company’s results and future outlook. To listen to the call, please dial 1-844-885-9139 (domestic toll free), or 1-647-689-4441 (international), and request to join the PREIT call, Conference ID 7187207, at least five minutes before the scheduled start time. Investors can also access the call in a “listen only” mode via the internet at the Company’s website, preit.com. Please allow extra time prior to the call to visit the site and download the necessary software to listen to the Internet broadcast. Financial and statistical information expected to be discussed on the call will also be available on the Company’s website.

For interested individuals unable to join the conference call, the online archive of the webcast will also be available for one year following the call.