PREIT Takes Steps to Improve Liquidity Position

Reduces Common Dividend

Executes Credit Facility Amendment

Significantly Reduces Capital Spending and Operating Costs

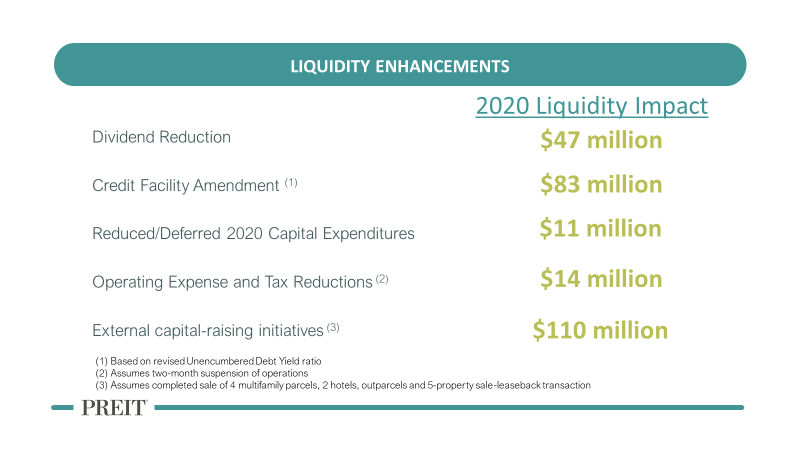

Philadelphia, March 31, 2020 – PREIT (NYSE: PEI) today announced a series of actions to strengthen its balance sheet and liquidity position during this unique operating environment, creating nearly $300 million in incremental liquidity.

“As we continue to navigate an uncharted operating environment, we are focused on safeguarding the safety and well-being of our associates and communities while enhancing near-term liquidity,” said Joseph F. Coradino, Chairman and CEO of PREIT. “PREIT was among the first companies in our sector to embark on a proactive effort to improve our portfolio through anchor repositioning and redevelopment, completing the program ahead of industry peers and in advance of the COVID-19 pandemic. We are now laser-focused on improving our balance sheet to position PREIT for long-term success.”

Dividend Policy

In response to the current environment and to enhance financial flexibility, the Company and its Board have decided to rightsize the Company’s quarterly dividend on common shares. Beginning with the second quarter dividend, the Company expects to pay a quarterly cash dividend of $0.02 per common share. This 90% reduction will enhance Company liquidity by approximately $15 million per quarter, or $60 million in additional liquidity on a full-year basis. The declaration and payment of dividends remains subject to quarterly action by the Board.

Credit Facility Amendments

As part of PREIT’s plan, the Company has executed amendments to its Senior Credit Facilities. The amendments modify certain covenants through September 30, 2020, and under the amendments, PREIT has increased its borrowing capacity by more than $83 million. A description of certain modifications is included as an addendum to this press release and a description and copies of the amendments will be included in PREIT’s form 8-K to be filed with the SEC.

Capital Spending and Operating Expense Reductions

The Company is reviewing its capital spending projections and expects to reduce its planned 2020 spending by 11% or $11 million. The Company is also proactively taking steps to reduce its operating expenses to further enhance liquidity and strengthen its balance sheet. Based on current forecasts, the Company expects to realize savings of approximately $2 million per month while mall operations are suspended.

Other Mitigation Efforts

The Company is working with outside advisors and its industry trade group, ICSC, to secure various forms of relief and funding at the federal, state and local levels. In addition to funding, the Company is working with officials to reduce its municipal tax liabilities, which, if successful, could potentially generate savings of over $10 million.

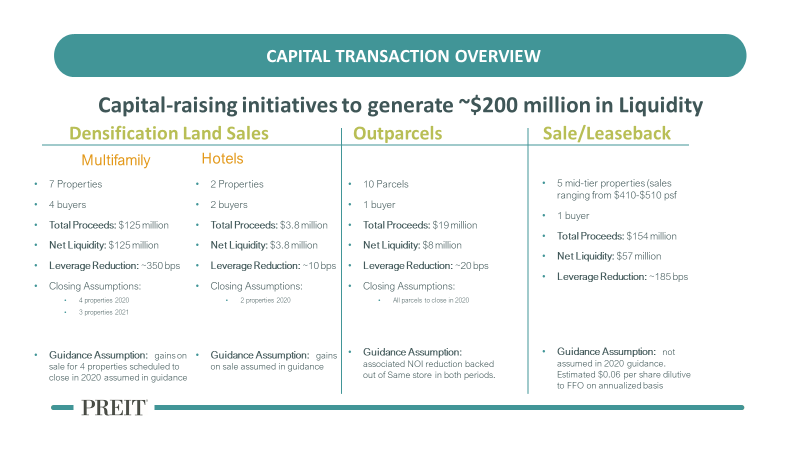

External Capital Raising Initiatives

PREIT also continues to pursue transactions to raise capital. As disclosed in its fourth quarter 2019 earnings release, the Company has executed agreements of sale for expected gross proceeds of $312.6 million. These include an agreement for the sale – leaseback of five properties, the sale of land parcels for multifamily development at seven properties, operating outparcel sales and the sale of land for hotel development at two properties. Upon closing of these transactions, the Company expects to net approximately $200 million in additional liquidity. Details regarding these transactions and associated assumptions are included in the addendum to this press release.

These actions, together, have the potential to create nearly $300 million of incremental liquidity, as detailed in the following chart:

Update on 2020 Earnings Guidance

PREIT expects its financial results for the remainder of 2020 to be impacted by continued global economic uncertainty related to the COVID-19 pandemic. Given the evolving nature of the situation, PREIT is withdrawing its financial outlook for 2020 provided in its February 25, 2020 earnings press release. The Company intends to provide a further update in connection with its first quarter earnings announcement.

PREIT Takes Steps to Improve Liquidity Position

Addendum

Select Terms of Credit Facility Amendments

- Total Liabilities to Gross Asset Value covenant has been increased to 65% through September 30, 2020,

- Adjusted EBITDA to Fixed Charges covenant has been reduced to 1.40x through September 30, 2020,

- Unencumbered Debt Yield covenant, which governs PREIT’s total unsecured borrowing capacity, has been reduced to 10% through September 30, 2020,

- The definitions of Adjusted NOI and Adjusted EBITDA has been modified to include the annualization of the revenues associated with redeveloped space that hasn’t been in occupancy for a year,

- Further, the amendments also include mandatory prepayment, amortization, pricing and other covenant changes that are not summarized here and will be described in PREIT’s form 8-K to be filed with the SEC.

External Capital-Raising Initiatives Detail